In addition to the standard final Full Payment Submission (FPS) and P60s, many UK employers will have additional year-end reporting obligations.

These include:

UK employers must report all taxable benefits in kind (BIK) provided to employees during the preceding tax period to HMRC. The report is due July 6 after the year end. Where employers are registered for voluntary payrolling of benefits with HMRC, they must submit their P11D (b) calculating the employer NIC Class 1a liability on the taxable benefits provided. No P11D forms are not necessary, but all employees must be provided with a breakdown of the taxable benefits included in their P60 for the relevant tax period.

- Termination payments over £30,000

If you paid genuine termination payments during the preceding tax period, and the amount exceeded £30,000, you must submit a summary to HMRC outlining the payments made and calculate the employer NIC Class 1a due. The due date for this submission is July 6, after the end of the tax year.

- Employment Related Securities (ERS)

If you operate any type of employee share scheme, you must file an ERS return before July 6 after the year end to report all chargeable events that occurred during the year – e.g., vestings, awards, grants, and the like.

- PAYE Settlement Agreement (PSA)

If you entered into a PSA with HMRC, under which you agreed to cover the tax liability on certain irregular or minor benefits for your employees, then any tax and employer NIC Class 1B is due for payment by October 22 for online payments. The informal due date for submitting your calculations and PSA return matches this date.

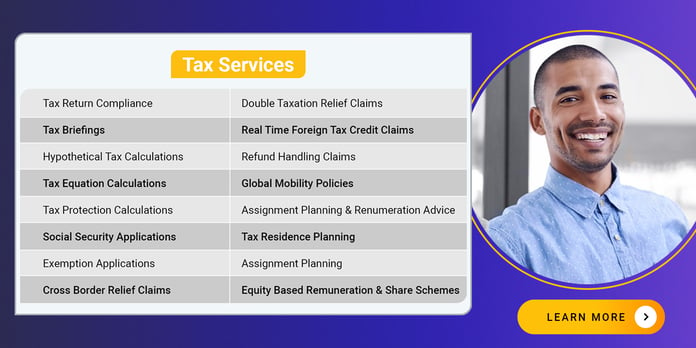

For more information on this or any other global mobility tax question, please contact the Immedis Tax team to discover the other services provided by the Tax Team at Immedis.